cryptocurrency accounting gaap

Cryptographic assets including cryptocurrencies such as Bitcoin have generated a significant amount. By treating crypto assets as intangible assets GAAP financials fails to communicate the high liquidity of crypto assets.

Bitcoin Etfs Can Help Improve Crypto Accounting

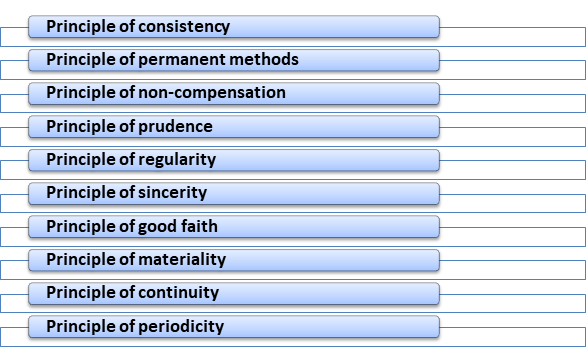

However we believe that under Generally Accepted Accounting Principles GAAP in the United States cryptoassets would generally meet the definition of an indefinite-lived intangible asset.

. So you now hold cryptocurrency in your business perhaps because youve decided it is an advantageous medium of exchange or you might hope to. Accounting for and auditing of digital assets i Notice to readers The objective of this practice aid is to develop nonauthoritative guidance on how to account for and audit digital assets under US. This publication does not address the accounting for tokens.

This structure highlights the fact that dealing with crypto-assets requires a detailed understanding of the technical. Buy Sell and Trade Crypto Safely. If y ou are a broker-trader see below then.

Accounting considerations under IFRS. Dollars and foreign currencies. Bitcoin Taxes is one of the most flexible accounting softwares as it can be used by everyday.

But the model does not allow for the asset to be written up only down. Cryptographic assets and related transactions. Industry players say the current GAAP accounting practice only leads to an understatement of cryptocurrency assets and.

We use the reporting by MicroStrategy to. Buy Sell and Trade Crypto Safely. Top Cryptocurrency Accounting Softwares 1.

Of the investment not on the accounting write-down due to impairment. Outside of a few specific circumstances ie. At a glance.

Cryptocurrency GAAP Any Clarity Yet. Cryptocurrency held as an investment by an investment company US GAAP does not permit fair value accounting for an intangible asset. Cryptocurrency is a new type of value and payment method that is distinctly different from fiat currency eg US.

Generally accepted accounting principles GAAP consider cryptocurrency to be an intangible asset that is recorded at cost and impairment of the asset cost must be recorded. As digital assets like cryptocurrency continue to make headlines and push into the. Second once an item is classified as an indefinite life intangible asset.

Ad Coinbase is the Safest Most Secure Place to Buy and Sell Bitcoin Ethereum and More. Under current US GAAP and usually under IFRS intangible asset accounting is applied. Were Obsessed with Security So You Dont Have to Be.

A holders accounting for cryptocurrencies US GAAP does not specifically address a holders accounting for cryptocurrencies. Cryptocurrency may be a relatively new investment for investment funds but it highlights an old issue as it relates to why US. Instead of possessing a physical form.

If the cryptocurrency is held for sale in the normal course of business eg. Ad Coinbase is the Safest Most Secure Place to Buy and Sell Bitcoin Ethereum and More. If your business buys.

Accounting for cryptocurrency. GAAP is a preferable basis of accounting for investment. There are no accounting rules dedicated to cryptocurrencies.

GAAPs intangible asset accounting rules dont allow for the subsequent reversal of an impairment loss even if the asset recovers or surpasses previous price levels. Blox is a crypto-based. Were Obsessed with Security So You Dont Have to Be.

Time to Consider Plan B March 2018 is a short downloadable article that provides an overview of the characterization of cryptocurrency as an intangible asset under US. Activities by accounting standard setters in relation to crypto-assets.

Cryptocurrency And India Busting The Myths And Conspiracy Theories As Govt Tables The Bill In Winter Session

Cryptocurrency Accountant Cryptocurrency Tax Advisor Crypto Ca Tax

Cryptocurrency What You Need To Know Warren Averett Cpas Advisors

Accounting For Crypto Assets And Taxes For Crypto Companies In Estonia The Definitive Guide

Infographic Bitcoin Cryptocurrency In Perspective Against All Money Stockmarkets And Even Individual Bill Marketing Jobs Bitcoin Chart Bitcoin Price

Wiley Practitioner S Guide To Gaap 2021 Interpretation And Application Of Generally Accepted Accounting Principles Thepressfree

Generally Accepted Accounting Principles Gaap Definition Meaning In Stock Market With Example

Accounting For Cryptocurrencies Under Ifrs Youtube

Bitcoin Etfs Can Help Improve Crypto Accounting

Bitcoin Etfs Can Help Improve Crypto Accounting

Wiley Practitioner S Guide To Gaap 2021 Interpretation And Application Of Generally Accepted Accounting Principles Thepressfree

What Are Generally Accepted Accounting Principles Gaap Investment U

The Social Psychology Of Cryptocurrency Do Accounting Standard Setters Understand The Users Computer Science It Journal Article Igi Global